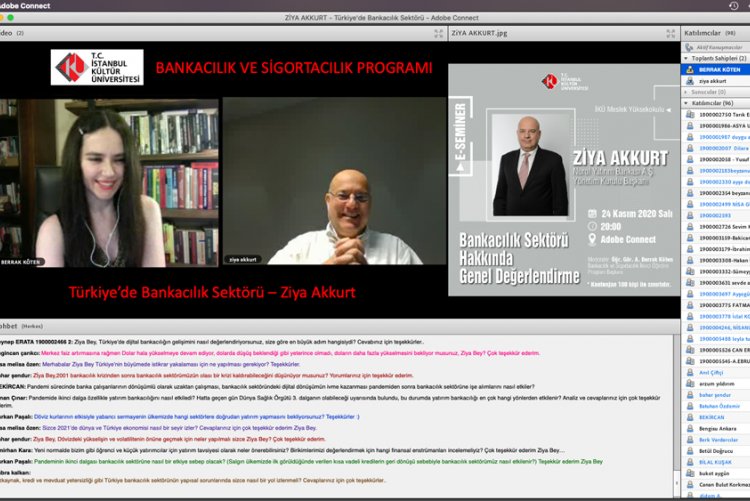

Istanbul Kültür University Vocational School organized an e-seminar titled "General Evaluation of the Banking Sector". The event was moderated by Lecturer Ayşegül Berrak Köten, Head of the Evening Education Program of Banking and Insurance and Nurol Yatırım Bankası Inc. Chairman of the Board of Directors Ziya Akkurt participated as a speaker.

Evaluating whether the measures taken and the support provided in the banking sector during the pandemic period were sufficient, Akkurt stated that the basis of the events was based on 2008, that the world could not get out of this situation with various political and economic breakdowns in 2008 and that an inclusive economic theory could not be produced to overcome this problem in an academic sense. Reminding that the financial system almost collapsed in 2008, Ziya Akkurt made a brief evaluation about the economic conjuncture before the pandemic. He reminded that in March 2020, recession was mentioned in the USA, that despite injecting so much money into the system, it was not possible to get out of the situation and FED President Powell started to reduce interest rates by following what Trump said. He drew attention to the fact that the money given with the pandemic was not enough and the interest rates were drawn almost to zero.

"At the beginning of the 2008 crisis, the FED's balance sheet was around 800 billion dollars, in 2012 it reached 4 trillion dollars. They later pulled it down to $ 3.8 trillion but couldn't lower it any further. They couldn't create inflation. " Using these statements, Akkurt emphasized that a similar situation is valid for the European economy.

Our guest said that the balance sheet of the FED is now going towards 8 trillion, and if it continues in this way, it will reach 10 trillion dollars. Underlining that half of the US $ 20 trillion GDP is circulating in the system in liquid form, Akkurt said, “Here we see that economic theories are blocked and cannot go forward. When the system is clogged, the first sector to be shocked and called for duty is the financial sector. Since the pandemic crisis, banks have been trying to keep the system alive by means of deferring debt and restructuring. " he said.

Ziya Akkurt reminded that in July and August, loans were distributed very cheaply in our country, people were burdened with buying houses and cars and prices were also inflated. Akkurt mentioned that a new economic model may emerge at the end of this process to solve the contraction and income distribution inequality accelerated by the pandemic both in our country and in the world.